Why every dollar counts when bidding on a used vehicle

Understanding auction fees is crucial when participating in Colorado car auctions or any other country-wide platform. What seems like a bargain at first glance can become a costly mistake if hidden charges sneak in. From buyer’s premiums to storage fees, every added cost increases your final bill, often significantly above the hammer price. This article breaks down exactly what buyers pay, how fees vary by auction type, and where most savings (or surprises) really come from.

What Are Car Auction Fees? The not-so-obvious costs behind the winning bid

At their core, such fees are additional costs layered on top of your final bid price. These fees are distinctive, but most fall into a few familiar categories:

- Buyer’s premium – A percentage (often 5–15%) added to the hammer price.

- Documentation fee – Charged for paperwork, title transfers, or sales contracts.

- Storage fee – Daily charge if you don’t collect your auto in the required timeframe.

- Administrative fees – Flat charges covering handling, platform use, or bidding registration.

- Relisting or cancellation charges – If you back out or fail to meet the sale terms.

These costs apply whether you’re buying a family sedan or a salvage truck, and the total amount you pay can be hundreds, even thousands, over your initial bid. Some vehicles may have a reserve price that must be met.

How Much Do Car Auction Fees Typically Cost?

From entry-level auctions to dealer-only access, prices vary

A common question asked by first-time bidders is as follows: How much are auction fees for cars? Let’s get specific. Here’s a breakdown of typical fees you might encounter:

| Auction Type | Buyer’s Premium | Other Fees |

| Public Auctions | 10–15% of hammer price | $150–$300 doc + storage fees |

| Dealer-Only Auctions | 5–8% | Lower admin, waived reg. fees |

| Online Car Auctions | 9–12% | Digital service, bidding line fees |

These numbers represent the average costs and vary by auction house, location, and even by day. Always check platform-specific terms before placing bids.

Fee Structures by Auction Type

The difference between convenience and cost

Not all auctions are created equal. Let’s make a comparison:

Public Auto Auctions

Open to anyone, but fees are typically higher. You’ll pay a standard buyer’s premium and additional admin costs. Since public auctions cater to casual buyers, they often offset risks with higher fee structures.

Dealer-Only Auctions

These require a license, but they come with perks. Fees may be waived, and the buyer’s premium is usually lower. High-volume sellers often collect discounts based on the number of vehicles sold per month.

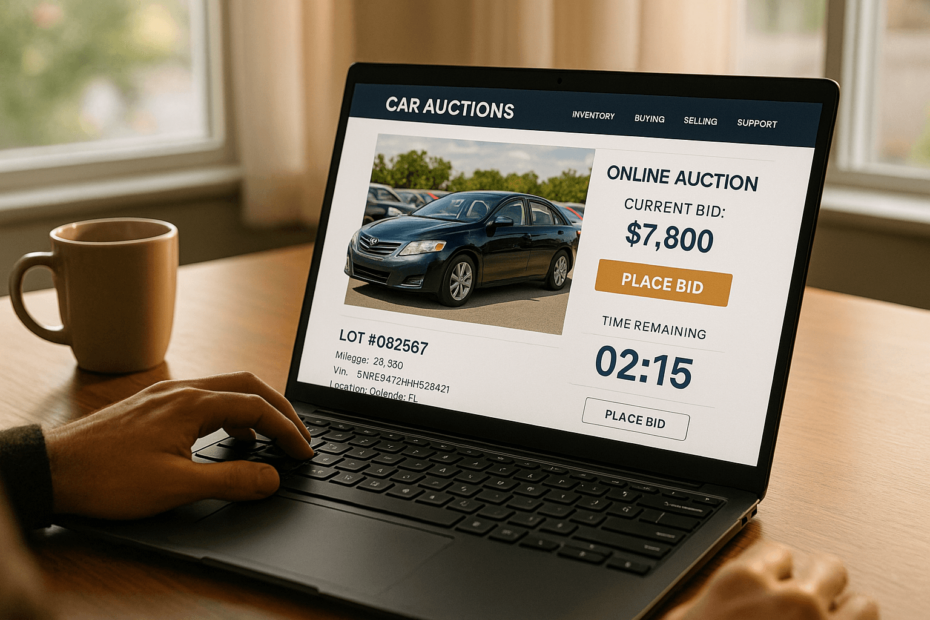

Online Car Auctions

The fastest-growing category. Sites often charge digital access fees, internet bidding surcharges, and transaction processing costs. Convenience comes at a price, but for remote bidders, it may be worth it. Online auctions frequently use a reserve system to ensure sellers get fair market value.

Example of Total Costs After Auction Fees

A $5,000 win isn’t a $5,000 deal

Let’s say you place the bid at $5,000. Sounds fair? Here’s what the total might actually look like:

- Hammer price: $5,000

- Buyer’s premium (10%): $500

- Documentation fee: $200

- Payment processing: $75

- Storage fee (2 days late): $100

Final bill = $5,875

That’s a 17.5% increase over the original bid. And in certain situations—like interstate shipping or title delays—it can rise further.

Hidden Fees to Watch Out For

Not every fee is advertised upfront

Some auction platforms bury extra charges in the fine print. Common culprits include:

- Mailing fees – Logistics documents to buyers post-sale.

- Relisting penalties – Charged when a person doesn’t complete the purchase.

- Online platform surcharges – “Technology fees” for digital bidding tools.

- Late payment – Some auctions impose flat penalties for delays as short as 24 hours.

Even the trailer used to transport your car might incur platform-specific costs if handled via partnered vendors.

Fee Policies of Major Auction Platforms

What Copart, IAAI, and SCA actually charge

| Auction House | Buyer’s Premium | Hidden Fees |

| Copart | 10–15% | Late pickup, gate fees, mailing |

| IAAI | 9–12% | Admin, digital access, relisting |

| SCA | 8–11% | Bid line, storage, final payment rush |

Each company uses slightly different terminology and pricing rules. Make sure to read the fine print or use their fee calculators to estimate total cost. Most of these sites outline fee structures clearly, but not all of them highlight penalties.

How to Reduce or Avoid High Auction Fees

Real strategies from seasoned vehicle buyers

These fees don’t have to eat up your margins. Smart buyers know how to minimize costs—even in high-fee environments. Consider these proven tactics:

- Bid only what you’re willing to pay after fees. Always calculate your maximum total, not just your hammer price.

- Buy in bulk. Some auction houses offer discounted fees to high-volume buyers or repeat bidders.

- Pay fast. Late payment penalties add up quickly. Stick to the platform’s deadlines.

- Pick up promptly. Storage fees kick in faster than expected. Coordinate logistics or use your own trailer.

- Focus on auctions with transparent pricing. Some platforms, including Colorado car auctions, outline all charges clearly up front, giving you the full price before you bid.

“Fees are only expensive when you don’t account for them,” says a veteran Colorado-based dealer. “Once you know how they work, you can bid smarter and avoid bad deals entirely.”

Are Dealer Licenses Worth It for Fee Savings?

When a $700 license might save $7,000 a year

For buyers flipping 10 or more cars per year, the math often supports getting a dealer license. Here’s why:

| Pros | Cons |

| Lower buyer’s premiums | Licensing requirements & inspections |

| Access to exclusive dealer-only sales | Annual fees & administrative paperwork |

| Discounted registration fees | Storage of cars must be compliant |

For someone flipping cars as a business, dealer licenses often streamline the vehicle purchase procedure and lead to better ROI, especially at larger auction house locations.

Are Car Auction Fees Tax Deductible?

Understanding the IRS treatment of auto buying costs

In many cases, such fees are deductible business expenses if you’re buying autos for resale or business operations. This includes:

- Buyer’s premiums

- Documentation fees

- Storage and shipping

- Licensing and registration fees

However, always consult a professional. The deduction depends on your filing status, business classification, and state laws. Don’t assume—get clarity, especially before the next season.

How Auction Fees Affect Car Flipping Profit Margins

From margin to mirage: where profit disappears

Car flippers often underestimate how much the fees reduce profit. Here’s a realistic breakdown using a compact sedan bought at a bid of $3,800:

- Buyer’s premium: $380

- Documentation: $200

- Transport: $275

- Prep & detailing: $120

- Local sale price: $5,200

Gross margin: $1,400

Total fees + expenses: $975

Net profit: $425

In this case, nearly 70% of the margin was absorbed by fees and related costs. If the car needed minor repairs, that deal would have crossed the loss line.

Set your maximum bid not by the auto’s book value, but by subtracting all projected expenses. Successful sellers reverse-engineer every bid to protect ROI. Some experienced flippers have negotiated better terms with auction houses they regularly work with.

Summary of Key Concepts

Auction buyers often fixate on the hammer price, forgetting that fees turn the winning bid into the final bill. Understanding how fees work across public, dealer-only, and online platforms helps buyers protect their budget and their profits. Whether you’re a casual buyer in Colorado or a full-time reseller bidding nationwide, staying informed is the smartest tool you can bring to the sales line.

FAQ

Are auction fees negotiable?

Generally not, unless you’re a high-volume dealer with a special agreement.

What is a buyer’s premium at a car auction?

It’s a percentage-based fee added to the hammer price. Usually 5–15%.

Do online car auctions have different fees than physical ones?

Yes. Expect internet bidding fees, tech platform surcharges, and document transportation costs.

Why do auction fees vary so much between platforms?

Each auction house sets fees based on services, locations, and business models.

Can I avoid paying storage fees after winning a car auction?

Yes—collect your car within the site’s free pickup window.

Are auction fees tax deductible if I flip cars as a business?

Often yes. But get personalized recommendations from an advisor.

Can I bid at a dealer-only auction without a license?

No. Only licensed dealers can legally access dealer-only auctions.

How can I estimate my total cost before placing a bid?

Use the site’s calculator or manually add all expected fees to your bid amount.